Table of Content

- Affordability is still a challenge

- What's next for the Bay Area housing market in 2023? Experts weigh in.

- Housing prices drop across California’s Bay Area

- California Home Price Trends 2022

- California Housing Supply

- Bay Area man with diabetes says health care changes puts life at risk

- Bay Area Real Estate Market Trends for October 2022

- Overpriced, Overwhelmed, Over it! Investigating California's Housing Crisis

October marked the fifth consecutive month with an annual price increase of less than 10 percent. It was the lowest sales level since February 2008 and the steepest year-over-year fall since December 2007, excluding the effects of the pandemic. Sales of existing single-family detached homes in California totaled a seasonally adjusted annualized rate of 274,040 in October. October’s sales pace was down 10.4 percent on a monthly basis from 305,680 in September and down 36.9 percent from a year ago, when 434,170 homes were sold on an annualized basis. Denver’s Mile High reputation still applies to the city’s elevation and, of course, its legal cannabis patrons—but not so much to the housing market. Carlisle noted that in the Bay Area specifically, the market reached an all-time high in the spring, making its prices among the highest in the country and creating an overheated market.

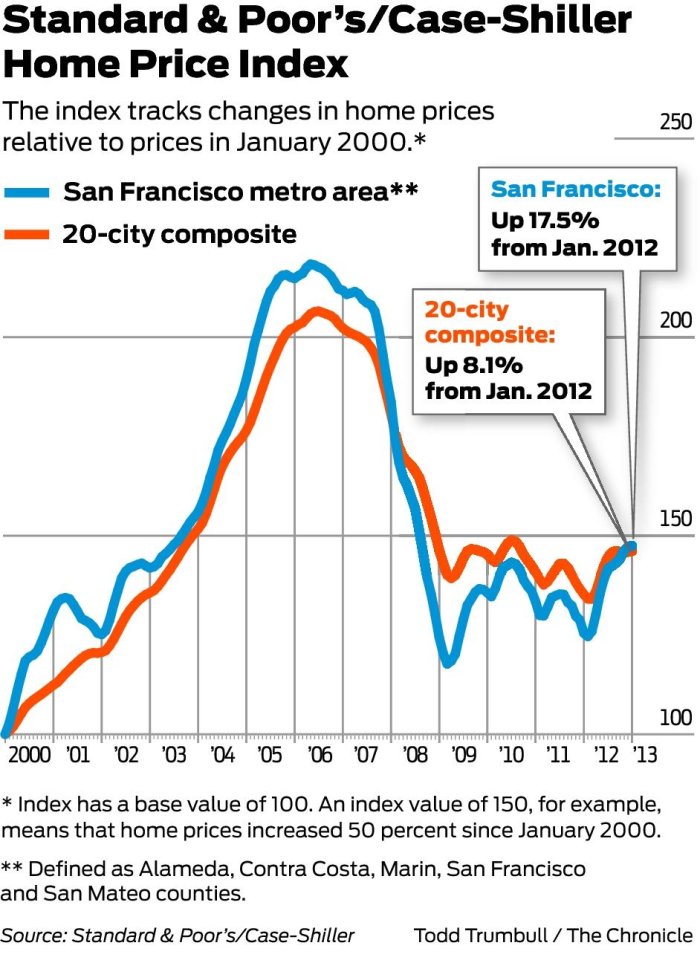

Many real estate investors have asked themselves if buying a property in San Francisco is a good investment as the median price for a two-bedroom sits at $1.35 million. The high cost of real estate in San Francisco is impossible for most families to manage. Exodus is yet another problem and a new report confirms that the numbers are staggering. Online real estate company Zillow released new statistics shining a stark light on the issue this week.

Affordability is still a challenge

Sign up for our fintech newsletter to get the a16z take on the future of fintech. For a single stock view, here’s how many shares of hypothetical Apple stock it would take for you to buy a house in the Bay Area. This is a family newspaper, please use a kind and respectful tone. “This has a lot to do with interest rates going up significantly,” Wei said Friday. And he predicted 2023 will see home prices continue to slide by about 8%. Compared to the same month in 2021, November home sales this year were 237,740 statewide (an “annualized” number that serves as a projection), according to the California Association of Realtors.

Home values in the San Francisco-Oakland-Berkeley metro, meanwhile, decreased 2.8% to $1.44 million. Another unintended side effect of regulations on San Francisco rental properties is that it incentivizes the construction of high-end units. Investors could invest in these projects or buy properties in the hopes that they are torn down and redeveloped. This is why burned-out husks can sell for hundreds of thousands of dollars and ones with demolition permits can sell for a million or more. The horrific stories of developers going through four years of red tape to build multi-family San Francisco rental properties deter others from even trying.

What's next for the Bay Area housing market in 2023? Experts weigh in.

The affordability issue means that, while all different property types are affected by price declines, more people are settling for smaller spaces that they can afford, Divounguy said. The California Association of Realtors estimated that the California median home price will fall 8.8% to $758,600 in 2023. Home prices in the Bay Area are likely to continue to fall through 2023, several data sources and experts said, with San Francisco expected to take the biggest hit. Ethan Varian covers the rental market and housing affordability issues as part of the Bay Area News Group’s housing team. He was previously a housing and homelessness reporter at the Santa Rosa Press Democrat in Sonoma County. His stories about housing, business and culture have been published in the New York Times, Los Angeles Times and the Guardian US, among others.

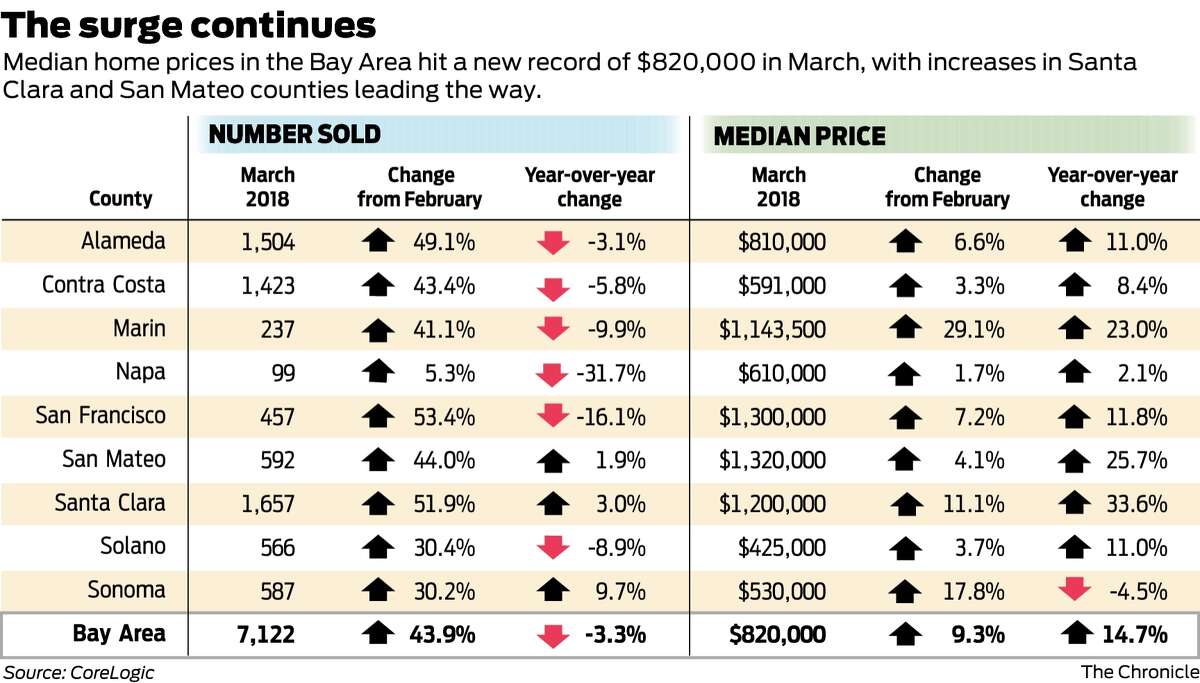

If you can afford it, then it’s an investment that will continue to increase in value over time. Not only that but sales in eight of the nine counties in the Bay Area fell more than 35 percent in October, with Napa plunging the most by 47.5%. The huge decline in sales occurs as mortgage rates increase, discouraging purchasers. After two years of pandemic-fueled growth to the Bay Area’s already sky-high home prices, home values are sinking quickly in the region, thanks to rising mortgage rates and a shaky stock market.

Housing prices drop across California’s Bay Area

Less than one-third of the people are optimistic about the economy's recovery. About 27% (-9% from last month) believe that economic conditions will improve in the state over the next 12 months while 73% still have a gloomy outlook. Each month C.A.R. surveys 1,000 California consumers regarding their sentiments about various aspects of the housing market or the economy that directly impact housing to create a California Housing Sentiment Index. In September 2022, the overall housing sentiment index was 55 (down 10% from last month). It showed that consumers acknowledged the current market challenges and felt increasingly pessimistic about homebuying opportunities. During the pandemic, flocks of San Francisco Bay Area homeowners sold their homes for big bucks and looked outward for cheaper real estate.

Looking at the current market shift, C.A.R. has reduced its 2022 housing prediction. The supply constraints and higher home prices will bring California home sales down slightly in 2022, but transactions will still post their second-highest level in the past five years. According to C.A.R., this is a 2 percent drop over the last October. Sales of existing homes were down in all the major regions of the California housing market. Southern California had the sharpest decline of all regions, with sales dropping -40.8 percent from a year ago. The San Francisco Bay Area (-37.3 percent) had the third-largest drop of all regions after the Central Coast (-38.8 percent).

For example, the laws governing the San Francisco real estate market allow you to buy San Francisco rental properties and evict the tenants to turn the units into condos for sale. Even with higher interest rates adding to the cost of a mortgage, the overall prices on homes may be lower. In a recent survey of real estate agents from real estate tech company HomeLight, only 30% of respondents said their market was a seller’s market in the fourth quarter of 2022. This is a swift decline from the 95% of agents who said they were in a seller’s market in the second quarter of 2022. A supply-demand imbalance will continue to put upward pressure on prices, but higher borrowing rates and partial adjustment of the sales mix will likely limit the median price rise.

About $750 million would be used for repurposing Google's own commercial real estate for residential purposes. This will allow for 15,000 new homes at all income levels in the Bay area. Another $250 million investment fund would be utilized to provide incentives to enable developers to build at least 5,000 affordable housing units across the Bay area housing market. The minimum annual income required for owning a house in the San Francisco bay area in 2019 was $197,970. That's an increase of 119.1% since 2012 when affordability was at its peak.

According to most experts, the market will continue to see moderate buyer demand and a positive rate of home price appreciation, despite a significant cooling from the extreme heat of early spring 2022. However, California is no longer a desirable location to live in since purchasers have endured exorbitantly high housing prices for years, and at least some homebuyers appear to have hit their breaking point. TheCalifornia housing market sizzled last year to break all records. At the regional level, home sales in all major California regions declined from a year ago, with four of the five major regions dropping more than thirty-five percent on a year-over-year basis. Home prices rose in all major California regions except San Francisco Bay Area and Central Valley. That’s likely at least partly due to the number of homes for sale rising nearly 70% year over year in September.

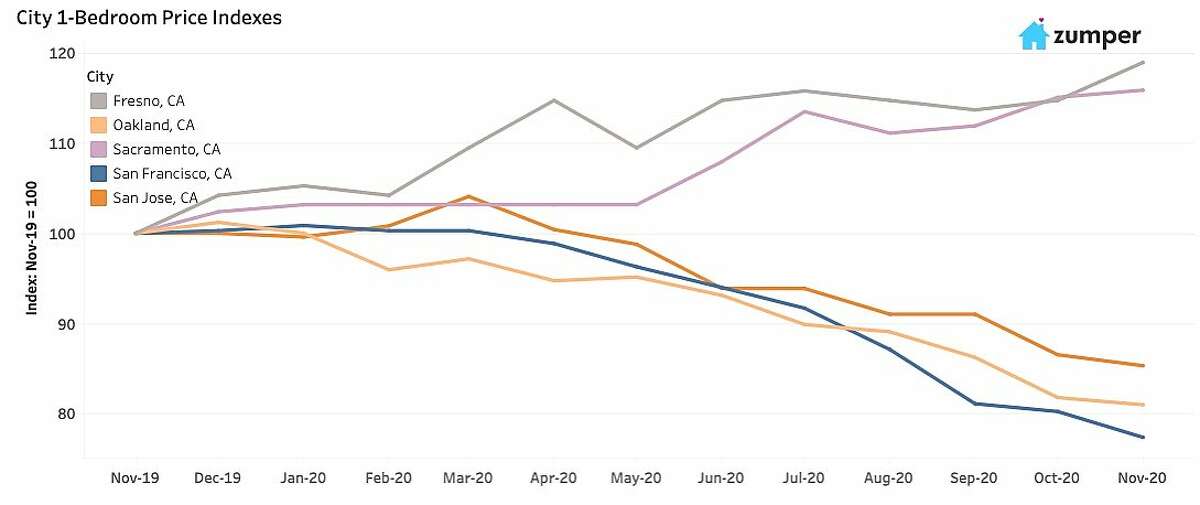

One report even said the Bay Area metro is no longer the least affordable housing market in the U.S. The rental market stayed fairly steady as well, remaining below pre-pandemic levels and showing no signs of reclaiming its title of the most expensive market in the U.S. Here's the California Housing Forecast for 2023 released by the C.A.R on October 12, 2022. High inflationary pressures will keep mortgage rates high, reducing purchasing power and lowering property affordability for prospective purchasers in the coming year. Data by CARBelow is the latest tabulated housing market report for the entire Bay Area released by the California Association of Realtors. The tabulated report shows the sales and prices of the Bay Area counties for October 2022.

But like other areas that saw big competition over a limited number of properties, the days of high prices appear to be waning. It’s about $20,000 less expensive than Daytona Beach to the north, and more than $100,000 cheaper than the Miami and West Palm Beach areas to the south. Businesses, baby boomers, and just about everyone else who was fed up with cold winters and high costs of living migrated to the Sunshine State, famed as much for its lack of income taxes as for its sandy beaches. Palm Bay, about an hour southeast of Orlando, along Florida’s Atlantic coast, absorbed some of those newbies. These changes can be chalked up to more than just the price deceleration of this time of year, says Realtor.com Chief Economist Danielle Hale.

If you know someone who has attempted to buy a home in the Bay Area lately, you’ve probably heard about the tight inventory conditions. This has been one of the biggest news stories of the past year, as far as the real estate market goes. A minimum annual income of $158,000 was needed to qualify for the purchase of a $797,000 statewide median-priced, existing single-family home in the fourth quarter of 2022. California’s median home price is forecast to decline 8.8 percent to $758,600 in 2023, following a projected 5.7 percent increase to $831,460 in 2022. According to the survey, close to two-thirds of Californians believe now is a good time to sell a home. Less than one-third of the consumers (30%) who participated in the survey still feel that home prices will continue to rise in the 12 months.

It is calculated by taking all estimated home values for a given region and month , taking a median of those values, and applying some adjustments to account for seasonality or errors in individual home estimates. Multifamily and home improvement spending grew 0.3% and 2.9% respectively, while single-family spending dropped 2.6%. Single-family spending has fallen for four straight months as rising borrowing costs impact building. The Fed approved a 0.75-point rate raise for the fourth time this year, but it may be the last. The latest hike pushed the target range to 3.75-4%, the highest since January 2008.

During the pandemic, San Francisco darling Che Fico added a controversial fee on top of tipping to support its workers. The funds go toward health insurance, 401 matching and paid parental leave — all rarities in the restaurant industry, made possible by its 10% dining-in charge. Despite receiving 2,300 doses from the federal government, people say it’s not enough. Yesterday, members of the city’s LGBTQ communities, led by Supervisor Rafael Mandelman, rallied at City Hall in hopes of pressuring local and federal governments for more monkeypox vaccines. San Jose is seeing the biggest drop in pending home sales of any Bay Area city, down 21% over the past year. (Though the biggest drop in the nation, at 39%, is… Boise, Idaho?) Oakland sales are down 16%, and San Francisco sales are down 14%.

No comments:

Post a Comment